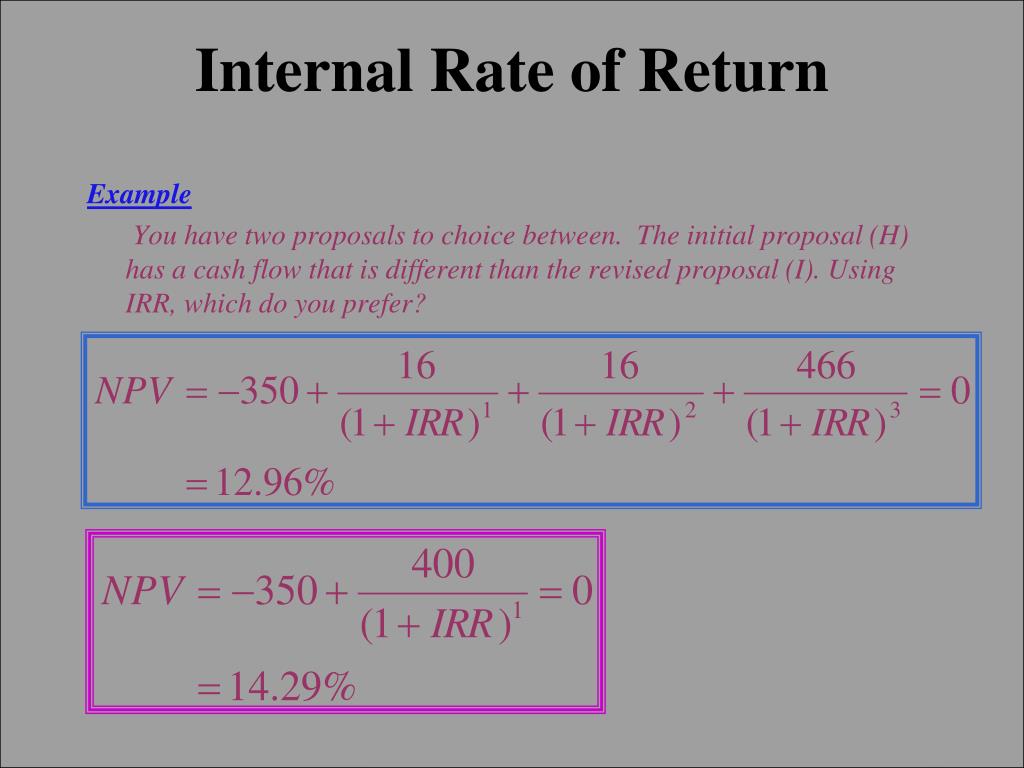

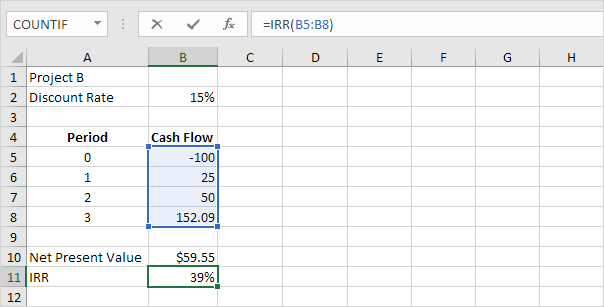

IRR calculations are commonly used to evaluate the desirability of investments or projects. Syntax IRR (values, guess) The IRR function syntax has the following arguments: Values Required. The internal rate of return (IRR) or economic rate of return (ERR) is a rate of return used in capital budgeting to measure and compare the profitability of investment. 13 Some of the less frequently used rates of return have similar bases. Instead of solving for NPV, the x we are solving for in the equation is the discount rate (typically signified as r in a DCF or NPV formula). The internal rate of return is the interest rate received for an investment consisting of payments (negative values) and income (positive values) that occur at regular periods. (MARR) and the external rate of return (ERR),15 the accounting rate of return (ARR), 14 the overall rate of return,3,4 the modified internal rate of return (MIRR),9 the effective rate of return,2 and the adjusted modified internal rate of return (ADJMIRR).

However, in this calculation, the net present value needs to be set to zero. IRR can be useful, however, when comparing projects of equal risk, rather than as a fixed return projection. Calculating the internal rate of return uses the same formula as discounted cash flow (DCF) or net present value (NPV). One of the disadvantages of using IRR is that all cash flows are assumed to be reinvested at the same discount rate, although in the real world, these rates will fluctuate, particularly with longer-term projects. The Excel IRR function can help you accomplish this task much easier.

#INTERNAL RATE OF RETURN TRIAL#

Without a computer or financial calculator, IRR can only be computed by trial and error. Gains on investments are defined as income. The IRR formula can be very complex depending on the timing and variances in cash flow amounts. The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of a project zero. Rate of Return: A rate of return is the gain or loss on an investment over a specified time period, expressed as a percentage of the investment’s cost.

0 kommentar(er)

0 kommentar(er)